pinellas county sales tax 2019

Each 2021 combined rates above are the results of the Florida state rate 6 the county rate 0 to 2. So the counties began imposing local bed taxes.

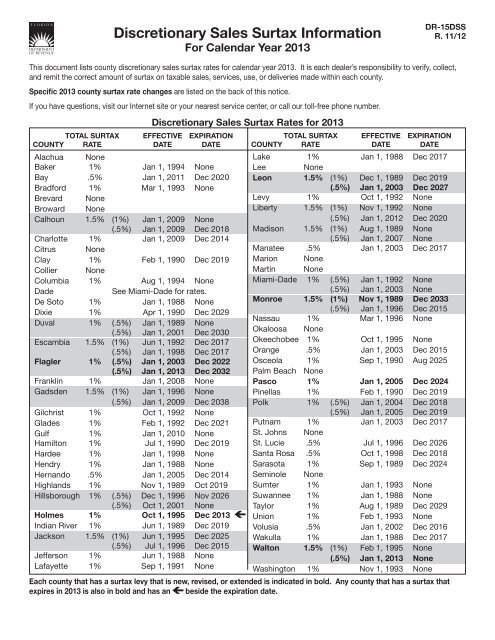

Discretionary Sales Surtax Information Florida Department Of

Pinellas county sales tax rate 2019 What is pinellas county sales tax.

. In addition Pinellas County residents will pay the 1 Pinellas County local option sales tax on the first 5000 of the taxable amount. Thomas raked in record-breaking tourist development tax collections for short-term hotel and rental stays for the 2019 fiscal year with 11 out of the last 12 months reaching all-timehighs. Tax Collector W-9 for Vendors.

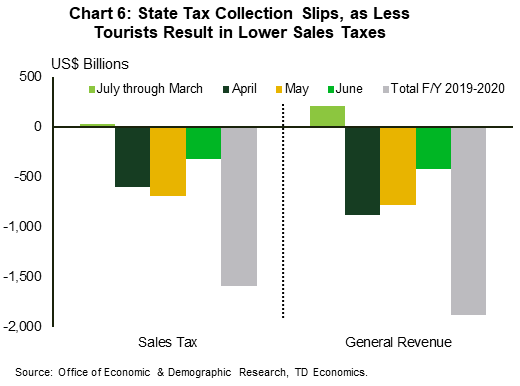

If you live in Miami-Dade County or Pinellas County you pay 1 county sales tax on the first 5000 of your vehicle purchase which adds 50 if your car costs 5000 making the state and county sales tax total 350. FL Sales Tax Rate. Are shown in the forecast as unfunded for the remainder of FY2020 and FY2021-FY2023.

The December 2020 total local sales tax rate was also 7000. Pinellas County Florida has a maximum sales tax rate of 75 and an approximate population of 724022. 60 to County Sales Tax Pinellas County charges a 10 percent Local Discretionary Sales Surtax specifically the Local Government Infrastructure Sales Surtax more commonly referred to as the Penny for Pinellas This sales tax was first adopted in 1987 and will expire at the end of 2029.

Depending on the zipcode the sales tax rate of clearwater may vary from 6 to 7 every 2022 combined rates mentioned above are the results of florida state rate 6 the county rate 1. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15There are a total of 367 local tax jurisdictions across the state collecting an average local tax of 1037. The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax.

The December 2020 total local sales tax rate was also 7000. How much is sales tax in pinellas county. The 6 state sales tax will be collected on the purchase price less any trade amount or previous sales tax paid in a state reciprocal with Florida.

Click here for a larger sales tax map or here for a sales tax table. Pinellas county sales tax rate 2019 What is pinellas county sales tax. Projects that would need to continue such as sidewalks paving bridges etc.

The 2018 United States Supreme Court decision in South Dakota v. Motor Vehicle Bill of Sale. Florida The Florida general state sales tax rate is 6.

The Florida state sales tax rate is currently. There is no applicable city tax or special tax. Motor Vehicle and Driver License Forms.

Fast Title Authorization Affidavit. Collections for the fiscal year totaled nearly 631 million surpassing the 60 million. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

Pinellas County FL Sales Tax Rate. Ad Find Out Sales Tax Rates For Free. Fast Easy Tax Solutions.

The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County. Combined with the state sales tax the highest sales tax rate in Florida is 75 in the cities of. Pinellas County Sales Tax Rate 2019.

PINELLAS COUNTY Pinellas County Tax Collector Charles W. This is the total of state and county sales tax rates. From 2018 to 2019 employment in Hillsborough County FL grew at a rate of 491 from 701k employees to 736k employees.

The current total local sales tax rate in Pinellas County FL is 7000. Florida has 993 cities counties and special districts that collect a local sales tax in addition to the Florida state sales taxClick any locality for a full breakdown of local property taxes or visit our Florida sales tax calculator to lookup local rates by zip code. For additional motor vehicle driver license mobile home and vessel forms please visit the Florida Department of Highway Safety and Motor Vehicles.

Driver License Requirements Checklist. Weve been notified that fraudulent emails are being sent to customers under the name of the previous tax collector Diane Nelson stating their account is delinquent and instructing customers to click the attachment for the amount due. Groceries are exempt from the Pinellas County and Florida state sales taxes.

The Pinellas County sales tax rate is. Sales tax rates in Pinellas County are determined by seventeen different tax jurisdictions Largo Belleair Bluffs Pinellas Dunedin Clearwater Hillsborough Seminole Pinellas Park Belleair Beach Tarpon Springs Gulfport Kenneth City Madeira Beach St. 05 January 1 2019 December 31 2030 5 July 1 2005 100 Living and Sleeping Accommodations 70 All Other Taxable Transactions 05 January 1 2017 - December 31 2026.

Are shown in the forecast as unfunded for the remainder of FY2020 and FY2021-FY2023. Certificate holders use Lienhub to run estimates and make application for tax deed. If you need access to a database of all Florida local sales tax rates visit the sales tax data page.

The combined rate is composed of the 6 state sales tax plus the 1 local government infrastructure surtax. In addition Pinellas County residents will pay the 1 Pinellas County local option sales tax on the first 5000 of the taxable amount. Jul 26 2019 Sales taxes and caps vary in each state.

The current Penny for Pinellas one cent local option sales tax ends December 31 2019. The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas county The current total local sales tax rate in pinellas county fl is 7000. The cities of Florida andor municipalities do not have a city sales tax.

You can find a downloadable PDF of the Florida Department of Revenue county surtax rates in Form DR-15DSS at the end of this article. In addition to increases to surtax amounts starting this year other counties have extended or revised surtax rates. The Penny for Pinellas became effective.

June 4 2019 329 PM. Property taxes in pinellas county. The cities of Florida andor municipalities do not have a city sales tax.

Property Tax Forms.

How To File A Florida Sales Tax Return Youtube

How To Calculate Fl Sales Tax On Rent

Florida Sales Tax Information Sales Tax Rates And Deadlines

U S State And Local Sales Tax Revenue 1977 2019 Statista

The Aesthetic Realtor Realtor Signs Realtor Social Media Real Estate Exam

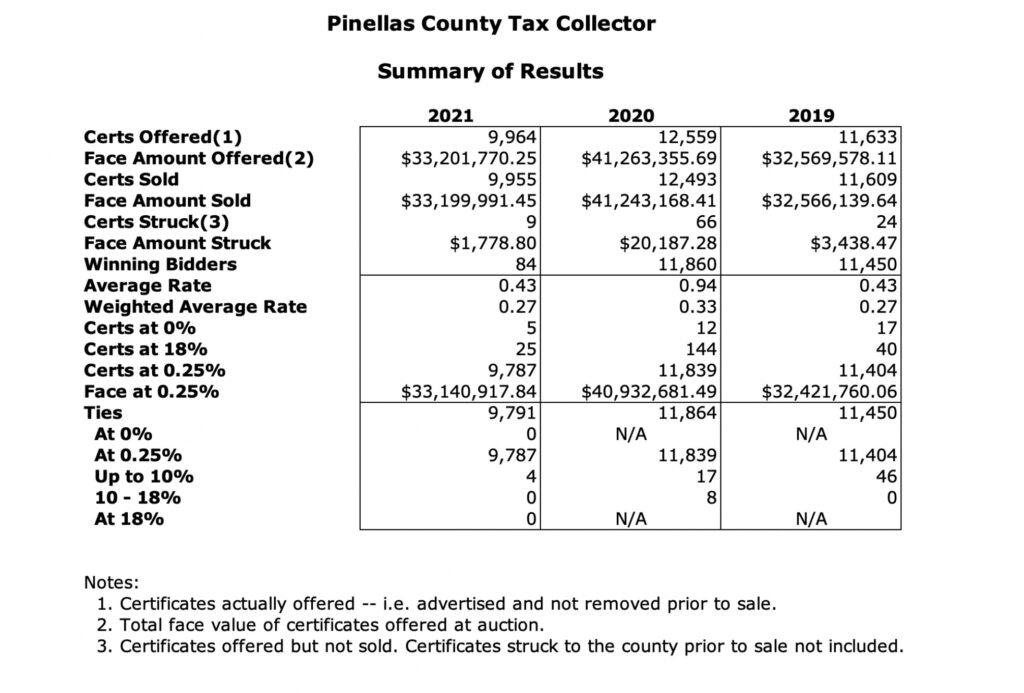

Tax Certificate And Tax Deed Sales Pinellas County Tax

Two Years To Remember The Impact Of The Pandemic On Florida S Tourism Industry

2021 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A

Florida Income Tax Calculator Smartasset

Tax Certificate And Tax Deed Sales Propertyonion

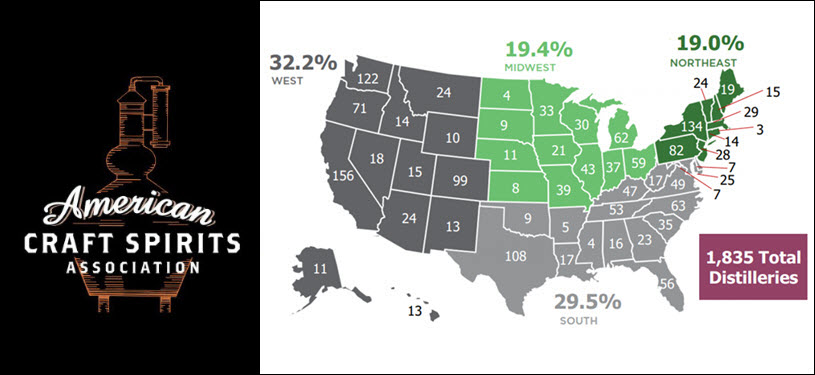

Acsa Releases 2018 Craft Spirits Data Project Sales Up 24 Number Of Distilleries Up 15 Full Report Distillery Trail

Florida Sales Tax Tiptuesday 3 3 2020 Business To Business Bookkeeping

:max_bytes(150000):strip_icc()/factors-affecting-real-estate-market.asp_final-8e8ea4cd40dd45909593384700de9759.png)

4 Key Factors That Drive The Real Estate Market

Jason Ohmann Enterprise Sales Director Five9 Linkedin

Sales Tax In Hillsborough County To Increase Jan 1

U S State And Local Sales Tax Revenue 1977 2019 Statista

File Sales Tax By County Webp Wikimedia Commons

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate